Appointment

Auto

We require full coverage insurance for an auto loan that Astera takes on as lien holders.

We have partnered with trusted insurance companies to offer you exclusive member discounts on products and services to meet your family’s needs and budget.

We offer exclusive member discounts on

- Home and Auto Insurance

- Health Insurance

- Life Insurance

For more information, please visit our Insurance page!

If the loan is paid off with cash, we are able to sign off on the title and release it immediately. If a loan is paid off with a Cashier’s Check or Money Order, in most cases the title will also be released immediately. The title for a loan paid off with a personal check will be released once the check has cleared.

Click here to contact us. A Member Service Representative will get back to you as soon as possible. Or, you can contact us at 517-323-3644.

We offer three convenient ways to apply to refinance your auto loan.

- Apply Online

- Click here here to get started!

- Apply by Phone

- Call us today at 800-323-0048 and a Member Specialist will walk you through the steps to apply over the phone.

- Apply in Person

- Stop by any of our branches and speak to a Member Specialist to get help on your application

Absolutely! Call us at 517-323-3644 or stop in to get pre-approved for an auto loan. Our pre-approvals are good for up to 30 days.

We offer competitive loans for new or used cars and trucks to get you back on the road in no time. Because we process loans in-house, you can expect quick decisions and efficiency. Consider getting pre-approved for better bargaining power, or refinance an existing non-Astera loan for a lower rate to save money! We do it all.

Changed

Recently Changed has gotten even better allowing you to pay down not just your student loan but other debts as well!

Changed can help you save money by paying down debts like:

- Student Loans

- Mortgage Loans

- Personal Loans

- Auto Loans

- More Coming Soon!

Security is something that we take very seriously at ChangEd. We’ve worked hard to ensure that our members information is, and continues to be, secure.

This includes:

- Banking credentials(which are never stored on our servers and are encrypted via bank-level security standards)

- Personal information(which is kept in a secure database for payment and account set up purposes only)

- Anythingelse that you share with us!

If you have more questions about how your information is being used and stored, please send us an email! We want you to feel safe/relaxed throughout this entire process.

Once you link your main spending account, ChangEd analyzes your transactions and makes transfers (based on your round-ups) to your ChangEd account.

ChangEd makes transfers when your accumulated change reaches at least $5 in roundups. We never withdraw more than $10 in one day in case you go on a spending spree and a ton of roundups occur. Once your ChangEd account reaches the balance threshold you set, the money will be transferred to your student loan debt.

Yes, you can analyze transactions for roundups from a linked credit card. All you have to do is add a checking account to fund those roundups.

Example:

Let’s say you add your checking account to your ChangEd App, and later link your credit card for us to analyze your spending and round up transactions.

In this case, we would round up transactions made on your credit card and make ChangEd transfers from your checking account based on the roundups you make with your credit card. We don’t want to be adding to your debt, right?

This is probably the toughest part of the whole process but we make it super easy. With most common student loan servicers you can use your online login credentials that you created with your servicer to securely link your loan information.

The second option would be to manually enter your loan info if your servicer is not covered with direct linking. This can be challenging sometimes so to compensate for that, we’ve built out a resources page to help you find all of the required information.

Our resource page will provide you a clear step by step guide to retrieving your (purposely hidden) information from a list of the most common servicers. We’ve got your back!

ChangEd supports all Federal and Private Student Loans. If you need help filling out your student loan information please email us at support@changedapps.com

ChangEd is free to download on the App Store and the usual $1 per month fee is waived for Astera members!

You can save thousands of dollars, shave years off of your loan, and reduce the need to budget for extra payments for only a buck a month! Seems like a fair deal, don’t you think?

Checking

The Kasasa qualifications calendar are the dates in which you must complete your Kasasa requirements to qualify for rewards for the month. Click here to view this years Kasasa calendar.

Overdraft Protection can offer you peace-of-mind even if you do not end up utilizing it! This service protects you in the case of non-sufficient funds. Transfers from a Line of Credit or from funds within your account can be utilized to avoid fees in the case of an overdraft. Your Overdraft Protection can also be covered by Courtesy Pay. This service comes with a $30.00 service charge every time it is used.

Having to take time out of your day to pay bills can be a real hassle. Avoid making late payments and pay bills from your own computer.

With our updated One-Click Bill Pay service, paying bills is faster and easier than ever! Need to pay a friend or family member? All you need is their email address and a shared password to quickly transfer funds to another person.

With features you can set up, like alerts and reminders, you’ll find it’s easy to keep up with your payments. Login to your online banking account to set up Bill Pay today!

With Bill Pay you can:

- PAY in just one click. Find the person or company, enter the payment amount and date, and click “Pay.”

- VIEW all payees, upcoming bills and payment history.

- ADD a new payee faster than ever. Click the “Add a payee” button to add a person or company.

- SET UP recurring payments and save time each month. Simply select “Make it recurring” next to your payee.

- SEE payment amounts and due dates of upcoming bills. Click on the “eBill” icon next to your payee.

To learn more about Bill Pay, click here to watch a demo.

At Astera, we offer several options in checking accounts. Our Kasasa Checking accounts do not require a minimum balance. Our Choice Checking account does come with a $5.00 service charge, for accounts that do not carry a $500.00 daily minimum balance, but you can choose to roll down that service charge by doing things you may already be doing such as:

- Enroll for E-Statements – $3.00 reduction

- Have at least 1 automatic direct deposit (ACH) or online bill payment clear per month – $1.00 reduction.

- Utilize your Astera Credit Union MasterCard debit card – for every transaction per month you will receive a $0.10 cent reduction.

A $30 fee will be applied to your account, in order to stop payment on a check/draft.

You have up to 30 days to bring your account current if it should go negative. The next thing you should do is take action to prevent this from happening again. How? Set up another account as a failsafe to transfer funds if your checking account happens to go negative for any reason. Or, you can sign up for Overdraft protection, which the credit union will cover any overages you accidently may incur.

To contact us please submit a question using the button below. A Member Service Representative will get back to you as soon as possible. Or, you can contact us at 517-323-3644.

Credit Builder

Astera Credit Union does offer Personal Loan and/or debt consolidations for our members to consolidate bills and pay off other debts. There are several options available to most members. This may include personal loans, home equity loans/lines, or even a first mortgage.

If you would like to discuss options before applying, simply call a Member Service Representative at 517-323-3644.

If the funds are in an Astera account, you are able to utilize Online Banking in order to process the payment. A payment can be made by transferring funds to the appropriate loan.

If the funds are in a financial institution other than Astera, you cannot make payment through Astera’s Online Banking. You can however, use the external financial institution’s Bill Pay service to make online payments. Or you can Make a Payment using our ACH tool. For future use, this link can be found under our Services tab.

Astera’s Audio Banking gives the member banking over an automated phone service. There is only one simple application to complete. Choose your four-digit personal identification number (PIN), and you’re ready to go. Use any touch-tone phone and perform a variety of transactions including loan calculations. Once you have your PIN, you can access Audio Banking by calling toll free at 1-888-222-8868.

To view our Audio Banking Guide, click here.

You are also able to utilize Online Banking or Mobile Banking in order to process the payment. A payment can be made by transferring funds to the appropriate loan. These payment methods are free of charge!

To contact us please submit a question using the button below. A Member Service Representative will get back to you as soon as possible. Or, you can contact us at 517-323-3644.

Credit Cards

- Verify that there is a Contactless symbol on the transaction terminal.

- Tap or hold your Mastercard within 3 inches or so to a transaction terminal.

A contactless card payment utilizes a Radio Frequency (RF) technology, allowing cardholders to “wave” their Contactless card over a Contactless-enabled point of Sale (POS) terminal. The embedded antenna transmits the payment info to the Contactless-enabled terminal using a one-time use code with each transaction. These new features allow for a secure, fast, and easy transaction process.

Your Astera Credit Card comes with complimentary Fraud Alert alerts. Fraud Alerts help fraud prevention by providing 24/7 monitoring of card activity to help protect your account(s) against fraudulent transactions. When unusual spending or transactions appear on your card you will receive a text message asking you to confirm the transaction. If the transaction is not yours by responding to the text will prompt us to block the card and report unauthorized usage.

There are multiple ways to report a card lost or stolen. If you misplaced your card but think it is not lost for good you can log into your Astera Card Controls App and lock your card by clicking the green padlock in the bottom left corner of the card image and the padlock will turn red. Now your card is temporarily blocked. If you find your card click on the padlock again to allow your card to be used for transactions again. If you ultimately deem the card lost in the Astera Card Controls App you can click on the image of the card. In the bottom right corner of the screen click on lost/stolen and follow the prompts to close your card.

The second option if your card is lost or stolen is to call us at 800-323-0048 and choose the option for lost/stolen card to speak to a representative and they will close your card.

Finally, you can visit us at any branch location and one of our team members will help you close and replace your card.

Yes, our cards work with all the major digital wallets, Apple, Google, Samsung, Garmen, etc.

You can update your pin for debit, ATM, or Credit Card by calling our toll-free PIN now number at 1-888-886-0083.

Debit

Call 517-323-3644 anytime to report your card lost or stolen. The representative will status the card lost or stolen immediately. Additionally, you will want to request a new debit card and PIN. A new PIN will be assigned to your debit card, however, you may customize your PIN once you receive the new card and PIN mailer.

Generally it takes 7-10 business days for you to receive your new card. If you need it sooner, ask the Member Service Representatives for alternative delivery options.

To replace your debit card a $10.00 service charge will be applied.

One benefit of being an Astera member is getting access to the lowest rates around.

Our Debit Cards are good at anywhere in the world that accepts MasterCard.

EmpowerMe

There are four main qualifications for the EmpowerMe Financial Program:

- Have a direct deposit to your account at Astera CU

- Have internet access to be able to access the Money EDU program

- You are willing to sign a commitment form so you are as committed as your coach

- You have the time to put into doing the tasks asked each week

There are a multitude of factors that contribute to your credit score and each person will come into the program with their own unique financial history as a starting point. While we cannot guarantee a specific score upon completion of Empower Me, what we can promise is that by participating in the program you are giving yourself a chance to make a profound impact on your total financial wellbeing. By learning about topics like credit and how to manage your money in conjunction with working with our coaches you will put yourself in a position to see positive gains to your credit score!

The program is designed to last about 12 months. We feel that this is the necessary timeframe to help build and reinforce positive money habits with your coach as well as this gives your credit score a chance to increase. That being said, you and your coach may decide after 12 months that there are still goals you are working towards and you would like to keep working together so the length of time can be tailored to meet your specific financial situation.

The EmpowerMe is completely free. There are a few requirements that must be met to stay in the program, but there is no cost to the member when joining into the EmpowerMe Financial Program.

Fraud

No. Commands can be sent as upper-case, lower-case or a mixture of both.

If you recognize all of the transactions present in the fraud alert. Simply reply “Y”, to confirm the activity as valid. Your card will automatically be unblocked and no further action is required. You may now complete any purchases that may have been declined.

To opt-out of text alerts, simply reply STOP to any text alert. You will no longer receive fraud alerts via SMS message. You may also opt-out by calling the number provided on the back of your card and asking to be opted out of Automated Fraud Alerts messages.

Most SMS messages have a maximum length of 160 characters per message. Some alerts may require multiple messages to provide you with all the necessary information. All SMS messages are paid by Astea Credit Union and you will not be charged for any text message alerts.

Please update your contact information as soon as possible so that alerts will be sent to the proper number on file. You will still receive alerts on your home phone number or email, if that information is on file. Accurate contact information is important so that we can reach you in the event we identify suspicious transactions on your account.

SMS fraud alerts will come from 919-37. You may want to save this number in your contacts with a name you will recognize for future alerts. We recommend ‘Astera CU Fraud Alerts’. Fraud alert messages sent from this number will also be labeled with the Credit Union’s name.

You will still receive automated fraud alerts via phone and email. A text messaging plan is not required, but is a great way to receive fraud alerts about your Astera Credit Union account.

Yes! Your security is our first priority! Our fraud alert messages will simply ask you to reply Y or N to confirm charges. We will never ask for your account number, card number, PIN number, or any other personal information via text message. If you ever receive a text message asking for any personal or identifying information, please do not respond. Call Astera Credit Union at (517) 323-3644 or Toll Free: (800) 323-0048 immediately to report the fraudulent text message.

There’s no cost to use the automated fraud alerts service. Astera Credit Union pays for all costs associated with sending and delivering the SMS fraud alert messages to your mobile device. This service is provided to you free of charge.

There’s no need to register for automated fraud alerts. As a member of Credit Unionyou are automatically eligible to receive fraud alerts via SMS, phone or email. Please make sure to review and update your contact information so that you will receive alerts should there be any suspicious transactions on your account.

Generic

Starting January 1, 2021, Internet Explore will no longer receive feature updates and will not support modern web application security.

We highly recommend using one of the supported browsers below:

- Google Chrome

- Firefox

- Microsoft Edge

- Apple Safari

To see your pending transactions you will need to log into Online Banking. Once there you will see a sub-tab at the top that says “View Holds and Pending ACH.” From here you will find any outgoing transactions still pending, and any direct deposit transactions that are pending.”

Keeping up with your Astera Consumer or Business MasterCard® account has never been easier. To check balances, review transactions, make payments, and more, log into your account.

With Astera’s Make a Payment tool, paying your loans is fast and easy to do.

Log into Make a Payment. If it is your first time using our Make a Payment tool, you will omit a password and will be directed to set that up in the following screens.

Our Make a Payment tool can also be accessed from the services tab at the top of the page.

Need additional help? Click here for our step-by-step guide.

Save to Win is our free prize-linked savings program that rewards members for contributing to their own savings account. Just open a 12-month Save to Win share certificate with at least $25, and you’ll be entered to win monthly and quarterly prizes. In addition to gaining regular interest on your savings, each additional deposit of $25 gives you more chances to win! Members can earn up to 100 entries per month, so the more you save, the more chances you have to win. Visit Save to Win to learn more.

The yourMONEY account was created for people between the ages of 15 and 25. It was developed with your unique financial needs and wants in mind. Whether you’re just starting out and deciding what college to attend, looking to buy a new car, or saving your extra money to buy your own place, the yourMONEY account will help you manage your finances.

Astera Wire Transfers Instructions:

- To Alloya Routing # 272478075

- For further credit to: Astera Routing # 272481952

- For final credit to: Member’s Name & Account # (no dashes or spaces) at Astera (specify checking or savings).

To initiate a wire request please schedule an appointment or call us at 800.323.0048.

There are three ways to change your email address on file with Astera Credit Union.

- Online – Simply log in to Online Banking and click on “Self Service” then “Personal Information” to make your edit.

- By Mail – Send your new email address to us in the mail. You must include your signature and the name change form.

- In Person- You can always stop by a branch location and meet with us personally. Bring a photo ID such as a Driver’s License for identification.

Email address changes for Online Banking or Bill Payment must be made in Online Banking on the tab where you signed up for those services.

Your email address for Account Alerts is changed in Online Banking under “My Updates” and “Preferences”.

Yes for our members only. You may stop in at any of our branch locations for our Notary services. There is no charge for members to use this service. Please bring along a photo ID.

We believe trading paper statements for e-statements helps save our precious resources, while cutting out unnecessary clutter. Losing the paper trail also means gaining security. The less you leave for identity thieves, the more you can avoid falling victim to fraud.

You can sign up for e-Statements through Online Banking. Sign in and enroll today!

Home Equity

One benefit of being an Astera member is getting access to the lowest rates around. Take out a loan to fund that major expense. We process loans in-house, from application to closing — without all the stress.

We offer various loans and services to match your desires

- Personal Loans

- Home Mortgage Loans

- Home Equity Loans

- Auto Loans

- Recreational Vehicle Loans

- Line of Credit

Click here, if you’d like to apply for a loan today.

For our Astera Equity products, the only out of pocket expense for equity is for an appraisal. As a service to our members Astera covers all other closing cost.

Wouldn’t it be nice to stop throwing your money away on rent and start building equity in your own home? Astera offers low-rate home mortgage loans, so you can start calling your own place “home” sooner than later.

Our stellar loan officers will be there to guide you through every step.

There are many great features to our Home Mortgage Loans

- Build equity in your home in Michigan, instead of paying rent to a landlord

- We offer free quick pre-qualifications for accurate budget shopping

- Choose from a variety of mortgage loan financing options

- Local processing ensures fast approvals and efficient processing

- Personal attentive service from start to closing

- Talk to an Astera expert lender today to get started

Visit our Mortgage Web Center and apply now!

We offer three convenient ways to apply to refinance your home equity loan.

- Apply Online

- Login to your online banking account and then select the Services tab to get started

- Apply by Phone

- Call us today at 800-323-0048 and a Member Service Representative will walk you through the steps to apply over the phone

- Apply in Person

- Stop by any of our branches and speak to a Member Service Representative to get help on your application

Our stellar loan officers will be there to guide you through every step of the process.

Visit our Mortgage Web Center and apply now!

Insurance

We have partnered with The Family Security Plan to bring you a suite of supplemental insurance products that are customizable to fit your lifestyle and budget. A Relationship Development Specialist from The Family Security Plan may call you from (517) 893-5128 or (517) 893-5129 to discuss benefits available to you and your family. These calls are legitimate and on behalf of The Family Security Plan and Astera Credit Union.

Yes! As a member of Delta Dental of Michigan, you have access to the nation’s largest dental networks: Delta Dental PPO and Delta Dental Premier. For more information click here!

If you have questions, please call the Delta Dental Customer Service team at (800) 524-0149.

Astera has partnered with SWBC to bring you three amazing products to help you should times get hard. Life happens every day; car accidents, injuries, loss of job, illness, the list goes on and on. With our loan protection offerings, you won’t need to worry about how you’re going to pay your bills should your household have a loss in income.

Click below to learn more about what protection Astera can offer you on your loans with us!

Take care of those you love with two options for life insurance. TruStage offers both Term and Whole Life insurance policies to meet your needs:

Term Life

- Provide protection for 10-, 15-, 20- or 30-year terms for a set number of years

- Offers premiums and benefits that remain the same or vary depending on your policy

- Offers lower monthly premiums to work with your budget

Whole Life Insurance

- Provides permanent coverage for your entire life

- Premiums stay the same throughout your lifetime

- You can borrow against the cash value and use the money for any needs that arise.*

For more information, call 1-888-416-2166 or visit TruStage.com.

To see what works best for you, give us a call. We’ll walk you through your choices in detail, answer your questions and help you arrive at a decision that makes sense.

*Any unpaid balance of the loan, plus interest, is subtracted from the death benefit.

Yes! Rising insurance costs and policy changes can be hard to decipher on your own. TruStage can compare health insurance plans from multiple carriers, get quotes, offer advice and help you in purchasing coverage that makes sense. For more information, call 1-888-416-2166 or visit TruStage.com.

TruStage™ Auto & Home Insurance Program

Made available to credit union members like you, the TruStage™ Auto & Home Insurance Program provides top-quality protection designed to fit your budget. You could enjoy discounted rates combined with online convenience and 24/7 claims service.

Get your free quote today by calling 1-855-589-2146.

Auto and Home Insurance Products are issued by leading insurance companies. The insurance offered is not a deposit and is not federally insured, sold, or guaranteed by any financial institution. Product and features may vary and not be available in all states. ©TruStage

LifeCents

No, you do not. LifeCents is configured to allow you to go through the platform in the way that makes the most sense for you. You can access any resource available through the Resources section, accessible through the navigation bar on the left of the screen.

LifeCents starts off with basic information about personal finances. Over time, the system uses your responses to make personalized recommendations for education and other resources that are the most relevant for you.

Each time you use LifeCents, your progress will be saved. You can spend as much or as little time as you like in the system and pick up where you left off the next time you return.

The information you enter into LifeCents is only ever used to help you get a holistic view of your financial health and to make better recommendations about helpful tools and resources. Your individual data will never be sold to third parties or used to try and sell you products.

LifeCents is available to you as a free resource. You will never need to pay for access to LifeCents.

LifeCents is accessible on your desktop computer, laptop, tablet, or smartphone through your internet browser. However, we recommend not using Internet Explorer to access LifeCents, as it does not always work as intended.

LifeCents is a tool developed for individuals who are looking to get a better handle on their finances.

This program helps ensure you have access to the resources and education most suited to your unique personal situation and needs.

LifeCents is an online financial wellness platform that helps improve your financial knowledge, habits, and mindset. You can access LifeCents from anywhere at any time.

Line of Credit

If the funds are in an Astera account, you are able to utilize Online Banking in order to process the payment. A payment can be made by transferring funds to the appropriate loan.

If the funds are in a financial institution other than Astera, you cannot make payment through Astera’s Online Banking. You can however, use the external financial institution’s Bill Pay service to make online payments. Or you can Make a Payment using our ACH tool. For future use, this link can be found under our Services tab.

To check the status of a loan application you must call 517-323-3644.

Sometimes you still can qualify with bad credit. Loans are based on your credit history not necessarily your credit score. Call us today, to discuss your options at 517-323-3644.

Mobile

Any transfers done via Mobile Banking are reflected immediately.

Depositing checks online or from your smart phone is available at Astera Credit Union. Download our app today to get started. The app will ask you to perform tasks such as uploading images of your check.

Note: Check deposits usually take 2 business days to deposit into your account, but can sometimes take up to 7 days. To see the status of your deposit, please contact us at 517-323-3644.

You will be sent a one-time PIN the first time you try to log in to your app. The PIN will be sent to the email address Astera has on file for you. This PIN will need to be entered the first time you log in and never again.

Any account on file can be viewed through our Mobile Banking app.

Astera provides its customers with the latest technology. Now you can manage your accounts from the convenience of your smartphone.

Download the app to have instant access to easy account management.

Mortgage

Mortgage programs, Equity Loans and Home Equity Lines of Credit each have different escrow requirements. If you’re interested in paying for your taxes and insurance outside of escrow, you may be able to. Some members even choose to pay one of the other out of pocket and Escrow the other. Please speak with one of our mortgage experts about your specific needs at 517-323-0020.

The Note is the written agreement that a property owner signs when taking out a mortgage. The mortgage note specifies the amount of money that was borrowed, the terms of the loan and the length of the loan.

An escrow account is established to hold money collected by your lender to pay your hazard insurance and property taxes when they become due. This is sometimes called an “impound account.

Lenders usually require escrow payments every month to ensure that they have enough to pay the insurance and taxes for you. This is a way for lenders to make sure their collateral is secure.

For instance, if your home were to burn down in a fire and you had failed to pay your hazard insurance premium; the lender would not be able to recoup the loss. In addition, if you fail to pay your property taxes, the government can foreclose on your property.

Insurance and taxes vary. You can find out the current taxes from the seller and seek quotes for hazard insurance coverage.

The specific amount of your closing costs will vary, here are the reasons why the fees may change:

- A home loan often involves many fees, such as the appraisal fee, title charges, closing fees, and state or local taxes. These fees vary from state to state and also from lender to lender.

- To assist you in evaluating our fees, we’ve grouped them as follows: third party fees, taxes and other unavoidable costs, and lender fees.

- Fees that we consider third party fees include the appraisal fee, the credit report fee, the settlement or closing fee, the survey fee, tax service fees, title insurance fees, flood certification fees, and courier/mailing fees.

- Third party fees are fees that we’ll collect and pass on to the person who actually performed the service. For example, an appraiser is paid the appraisal fee, a credit bureau is paid the credit report fee, and a title company or an attorney is paid the title insurance fees.

- Fees that we consider to be taxes and other unavoidable costs include: State/Local Taxes and recording fees. These fees will most likely have to be paid regardless of the lender you choose. If some lenders don’t quote you fees that include taxes and other unavoidable fees, don’t assume that you won’t have to pay it. It probably means that the lender who doesn’t tell you about the fee hasn’t done the research necessary to provide accurate closing costs.

- Lender fees such as points, document preparation fees, and loan processing fees are retained by the lender and are used to provide you with the lowest rates possible.

Astera offers our members a lot of options when it comes to finding the right mortgage or equity for each member’s unique situation. Each loan type can have different rules regarding closing costs. You may be able to roll some or all of your closing fees into your loan. When purchasing a new home you may even be able to negotiate the seller to pay some of your closing fees. Please talk with one of our Mortgage experts to find out what your options are at 517-323-0020.

By getting pre-approved, you will know exactly what your budget will be when shopping for a new home. It eliminates the stress of finding the perfect home, only to find out you cannot get financed for the amount that house is selling for.

Wouldn’t it be nice to stop throwing your money away on rent and start building equity in your own home? Astera offers low-rate home mortgage loans, so you can start calling your own place “home” sooner than later.

Our stellar loan officers will be there to guide you through every step.

There are many great features to our Home Mortgage Loans

- Build equity in your home in Michigan, instead of paying rent to a landlord

- We offer free quick pre-qualifications for accurate budget shopping

- Choose from a variety of mortgage loan financing options

- Local processing ensures fast approvals and efficient processing

- Personal attentive service from start to closing

- Talk to an Astera expert lender today to get started

Online Banking

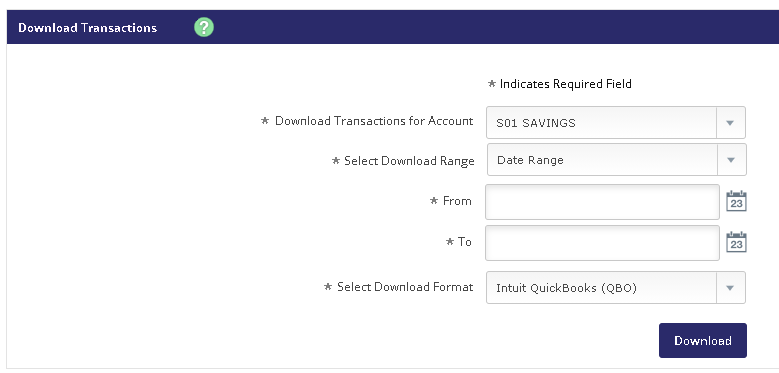

First, you must be logged into your online banking account. You can reach the download from the Transactions dropdown located in the upper menu, and then click on Download. You may also click on the dropdown box located at the end of each share line on the main account summary page and select Download. Each share is treated individually so you have to select which share you want to download, then select date range and format. Finally for download format, select Intuit QuickBooks (QBO).

Updating your information is easy! Simply follow the instructions below:

- Log into your Online Banking account.

- If you do not have a Online Banking account, register for one by clicking here.

- Click on the Settings tab at the top of the page

- To change your email address:

- Click the Personal tab

- Enter updated email

- To change your mailing address

- Click the Address Change tab

- Enter updated mailing address

- To change your email address:

- Click Submit

If you are unable to update your account online, please call us at 800.323.0048 to speak with a Virtual Branch Representative.

To make a transfer from your checking account to your loans through Online Banking, click on Transfers. Select the share you want to transfer from and the loan you want to transfer to.

While logging in with your user name, you can click on the “Forgot Password” link and setup a new one.

Yes, you can access your account through online banking 24 hours a day, 7 days a week. You can also track all your finances and budget your money using MoneyDesktop within Online Banking.

To contact us please call us at 517-323-3644 to speak with a member service representative.

Bill Pay through Astera Credit Union does allow you to make loan payments from another financial institution monthly. Please note the first payment through Bill Pay should be made 10 days in advance in order to ensure that the payment is processed on time.

There are NO fees for using our Online Banking service.

Members can easily manage accounts from their own computers — free of charge. Log on to easily check account balances, transfer funds, make loan payments, and more.

Any account you have with Astera, can be viewed with Online Banking.

Members can easily manage accounts from their own computers — free of charge. Log on to easily check account balances, transfer funds, make loan payments, and more.

Personal

Sometimes you still can qualify with bad credit. Loans are based on your credit history not necessarily your credit score. Call us today, to discuss your options at 517-323-3644.

To check the status of a loan application you must call 517-323-3644.

Astera’s Audio Banking gives the member banking over an automated phone service. There is only one simple application to complete. Choose your four-digit personal identification number (PIN), and you’re ready to go. Use any touch-tone phone and perform a variety of transactions including loan calculations. Once you have your PIN, you can access Audio Banking by calling toll free at 1-888-222-8868.

To view our Audio Banking Guide, click here.

You are also able to utilize Online Banking or Mobile Banking in order to process the payment. A payment can be made by transferring funds to the appropriate loan. These payment methods are free of charge!

To contact us please submit a question using the button below. A Member Service Representative will get back to you as soon as possible. Or, you can contact us at 517-323-3644.

RV

Sometimes you still can qualify with bad credit. Loans are based on your credit history not necessarily your credit score. Call us today, to discuss your options at 517-323-3644.

Our loans are done in-house so getting an answer is quick, usually within minutes. For faster results, stop into a branch and get results even faster.

Yes, we are proud to offer motorcycle loans!

Apply for your motorcycle loan online today. Call us at 517-323-3644 or stop into any of our branches to apply.

Savings

Direct Deposit is a free, convenient and reliable service where members may have their regularly recurring checks deposited automatically to the credit union by EFT (electronic funds transfer).

Our Routing Number/ABA is 272481952.

Under the requirements of the Patriot Act, all banks must do an identity check on a new customer. They use “customer identification programs” (CIP) that compare your name, address, date of birth, and other facts to the information contained on your credit report. Your credit score would not be damaged by that step.

The CIP regulations require institutions to implement reasonable procedures for:

- Verifying the identity of any person seeking to open an account, to the extent reasonable and practicable

- Maintaining records of the information used to verify the person’s identity, including name, address, and other identifying information.

Banks also review ChexSystems and sometimes credit report data during the process of determining if a customer qualifies to open a new account. Under FCRA regulations, the bank has to have a permissible purpose such as “intend[ing] to use the information in connection with a credit transaction involving the consumer” in order to pull a credit report and must obtain the consumer’s consent first. A hard inquiry like this could cause a small credit score ding.

Kasasa Saver is our savings account that pairs with our Kasasa Checking accounts. This savings account comes with high dividends earnings.

Shared Branching

You don’t have to fret over being caught out of town without access to your credit union. Astera is part of a network of credit unions across the U.S. you can visit whenever you travel.

Details:

- Access over 5,000 credit unions all over the United States

- Bring the following with you when you visit an in-network credit union:

- Valid government issued ID

- Astera account number

- Several easy ways to find the nearest branch

- Online credit union locator

- Credit union app

- By text

- By calling 1-888-748-3266

Yes! We allow members of other credit unions to come into our branches to conduct transactions.

Just about! The services offered to you at a shared branch include:

- Withdrawals

- Deposits

- Loan Payments

- Money Orders

- Cashier Checks

Skip a Pay

Astera CU is happy to offer 2 ways to apply for Skip-a-Pay.*

- Stop into any branch or call us at 800.323.0048 and we’ll be happy to assist you. A fee of $30 for each approved Skip-a-Pay applies for in branch applications.

- Log into your Online Banking account and submit your application and pay a discounted fee of $20 for each approved Skip-a-Pay online application.

As long as the program qualifications are met, you are allowed a payment skip at any point in the year, once every 12 months.

Snap Cash

SnapCash Loans are perfect for quick loans to help you get by until your next paycheck. Whether you need a little extra cash for college, groceries, an emergency car repair, or anything in between, a SnapCash loan can help. With just 6 clicks, in 60 seconds you can apply directly from your Astera mobile app and have the funds deposited directly in your Astera account, anytime, anywhere.

Use SnapCash Loan to:

- Avoid late payment fees on bills

- Pay for groceries

- Make a loan payment on time

- Assist with emergency expenses

- Keep you on your feet until your next paycheck

Requirements:

- Must be a member for six (6) months or longer.

- Must be 18 or older to apply.

- Members can have one (1) SnapCash loan at a time.

- Maximum of three (3) SnapCash loans over a six (6) month period.

Applying is easy and can be done in 6 clicks in 60 seconds!

First, you will need to have the Astera mobile app downloaded onto your phone. After you are logged into your account, you can access the SnapCash application page by clicking on the menu button and clicking on “Apply for a SnapCash Loan”.

Student Loans

There are steps that are taken after your loan is approved. Understand what happens before your loan is disbursed.

We’ve got details on what you’ll need to start the loan application process and what we do once we have your application. Learn more about the student loan application process.

It may take 24 hours for documents to come through and for your account to be updated.

Zogo

Do you have a smart phone? Do you want to learn how to maximize your finances? Do you like earning free rewards? I’m guessing you answered yes to all of these questions, which means YES, Zogo is perfect for everyone looking to learn more about how to handle their personal finances in their own time. The simplicity of taking modules from the comfort of your smart phone and being rewarded for it, is the perfect combination of education and pleasure.

Pineapples are a fun way to track your points. Each module you complete will award you a set amount of pineapples. You can then take those pineapples and trade them in for gift cards of your choosing.

Zogo is a free to use tool that not only educates you on finances, rewards you as well! By completing modules you earn pineapples which can be traded in for prizes!